The birds are singing their sweet songs as they busily build their nests. Deciduous trees are covered with new buds that will soon burst with leaves. The days are starting to get longer and warmer, inviting everyone to sit on their porches and lounge in a little extra evening sunshine. Spring is just about here, less than two weeks away, the beginning of housing’s Spring Market.

Spring is not only a season of flower blossoms, butterflies, and new life, it is a time when more real estate activity occurs than any other time of the year. It is when the inventory rises and demand surges and peaks. Many mistaken the summer as the best time of the year for real estate, but it is second to spring. During the spring, more homes are listed, there are more new escrows, and there are more closed sales than any other season.

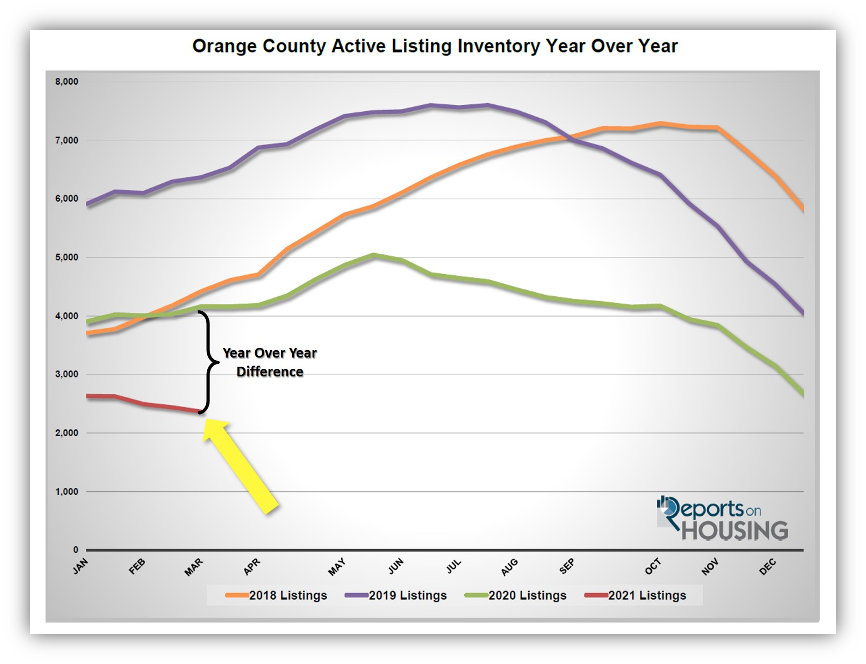

The spring of 2021 will be no different. The issue right now is that there are simply not enough homes available to satisfy today’s insatiable buyer’s demand. With only 2,366 homes on the market, the lowest level since tracking began in 2004, it is as if the family car’s low fuel light is “on” and everyone crosses their fingers and toes that there are enough fumes in the gas tank to safely arrive at the closest gas station. There are 43% fewer homes available to purchase compared to last year’s 4,161 homes to start March. That is 1,795 fewer FOR-SALE signs. Making matters worse, there were 447 fewer homes placed on the market in January and February compared to the prior 5-year average, 7% fewer. While that may not seem like a lot, ask any buyer if they want to see more homes placed on the market. At this point, every additional home is a welcome relief.

The big question right now is “when are there going to be more homes coming on the market, and how many?” In analyzing the data, it starts in March, the beginning of spring. An elevated number of homes hit the market from March through July, peaking in May. According to the 5-year average, the difference between March and May is only 216 homes, 5%, while the difference between February and March is 744 homes. On average, there are 23% more homes in March compared to February. Everyone can be rest assured that the welcome sight of more homes entering the fray has finally arrived and will remain at nearly the same elevated level through July.

The 5-year average is taken from the years 2015 through 2019 because 2020’s numbers were heavily skewed due to the pandemic. Comparing any data to last year in real estate will not be helpful from right now until the end of the year. It is better to look at an average of data from prior years.

Orange County Housing Summary

- The active listing inventory decreased by 72 homes in the past two-weeks, down 3%, and now totals 2,366, its lowest level since tracking began in 2004. In February, there were 10% fewer homes that came on the market compared to the prior 5-year average, 319 less. Last year, there were 4,161 homes on the market, 1,795 additional homes, or 76% more.

- Demand, the number of pending sales over the prior month, increased by 95 pending sales in the past two-weeks, up 3%, and now totals 2,958, its strongest start to March since 2012. The ultra-low mortgage rate environment is continuing to fuel today’s exceptional demand. Last year, there were 2,583 pending sales, 13% fewer than today.

- The Expected Market Time, the number of days to sell all Orange County listings at the current buying pace, decreased from 26 days to 24, an extremely Hot Seller’s Market (less than 60 days) and the strongest reading since tracking began in 2004. It was at 489 days last year, slower than today.

- For homes priced below $750,000, the market is a Hot Seller’s Market (less than 60 days) with an Expected Market Time of 17 days. This range represents 30% of the active inventory and 41% of demand.

- For homes priced between $750,000 and $1 million, the Expected Market Time is 16 days, a Hot Seller’s Market. This range represents 17% of the active inventory and 25% of demand.

- For homes priced between $1 million to $1.25 million, the Expected Market Time is 22 days, a Hot Seller’s Market.

- For homes priced between $1.25 million to $1.5 million, the Expected Market Time is 22 days, a Hot Seller’s Market.

- For luxury homes priced between $1.5 million and $2 million, the Expected Market Time decreased from 39 to 31 days. For homes priced between $2 million and $4 million, the Expected Market Time decreased from 60 to 55 days. For homes priced above $4 million, the Expected Market Time decreased from 147 to 117 days.

- The luxury end, all homes above $1.5 million, accounts for 38% of the inventory and only 15% of demand.

- Distressed homes, both short sales and foreclosures combined, made up only 0.3% of all listings and 0.2% of demand. There are only 6 foreclosures and 1 short sale available to purchase today in all of Orange County, 7 total distressed homes on the active market, up 1 from two-weeks ago. Last year there were 36 total distressed homes on the market, more than today.

- There were 2,250 closed residential resales in January, 24% more than January 2020’s 1,817 closed sales. January marked a 27% drop over to December 2020. The sales to list price ratio was 99.0% for all of Orange County. Foreclosures accounted for just 0.04% of all closed sales, and short sales accounted for 0.13%. That means that 99.82% of all sales were good ol’ fashioned sellers with equity.